Do you remember the Apple II series of personal computers? I certainly do. I got my first one in January 1983 (the Apple IIe) and it was a revelation. Back then the Apple II dominated the personal computer space (IBM was just introducing the first IBM PC). It was a serious cash cow for the new wonders of Silicon Valley: Steve Jobs and Steve Wozniak.

Do you remember the Apple II series of personal computers? I certainly do. I got my first one in January 1983 (the Apple IIe) and it was a revelation. Back then the Apple II dominated the personal computer space (IBM was just introducing the first IBM PC). It was a serious cash cow for the new wonders of Silicon Valley: Steve Jobs and Steve Wozniak.

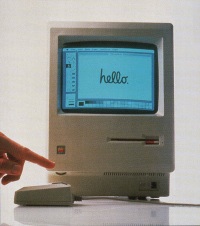

But even in 1983, in the peak of this tremendous success, Apple was reinventing the personal computer. They were secretly inventing the Macintosh, which was introduced a year after I got that Apple IIe in January 1984 (with the famous Superbowl ad).

Developing the Mac was a massively expensive proposition. New chips, new software, new case designs, a mouse, even a brand new 3.5″ floppy drive developed by Sony but still considered cutting-edge and risky. Everything called for clean slate development in order to get it all just right.

So what funded this engineering miracle? The successful and highly profitable Apple II series. And guess what — the Mac wasn’t profitable at launch. That first year was deadly. Apple introduced a $2,500 computer ($5,100 in 2007 dollars) that had two software programs: MacPaint and MacWrite, and it wasn’t compatible with the growing library of Apple II software titles.

Check out this brief video (43 seconds) of Guy Kawasaki recounting how the Mac team was funded by the Apple II team, and the considerable tension this created:

I often think of the Apple II / Macintosh example when conversations in public media circles turn to the question of how will we pay for this new media stuff that doesn’t make any money and takes money out of the profitable broadcasting business. Newspapers and the music industry are also great analogies for public broadcasting.

It takes real leadership, real courage to deliberately take cash from a profitable and successful unit and sink it into the next big thing, even if it takes years for it to pay off. Plus, you have to deal with the political pressures to stop funding this financial black hole from the “reasonable” business people all around you (on the board, on the management team, in the community, on the staff). As I look at my own public media business today, we’ve not even begun to seriously tackle the challenges of the new media world — chiefly because “Apple II” folks are in charge. I often wonder whether we should give up trying to reform the core of the company (a la Ideastream) and simply fund an external unit that can focus on the new media challenge without interference from the traditional “cash cow” part of our business.

The one example of “put it outside the core” I know of in the public media world can be found at Chicago Public Radio. Their Vocalo project (as described by Robert Paterson), is an external unit in every sense of the word. They have separate facilities, a new name unaffiliated with the old name, a separate budget, different leadership, different content and business models, etc. It’s a fascinating approach, and it mimics the Apple experience.

But I’m wondering… is anyone else in public media doing this? Who else, if anyone, is creating distinct subsidiaries for innovation? Is anyone else willing to spend their Apple II money on their Macintosh project?

You said, “It takes real leadership, real courage to deliberately take cash from a profitable and successful unit and sink it into the next big thing.”a

Imagine the leadership it will take to take cash from a failing unit. Perhaps that is what it will take, some necessity to mother the innovation.

You said it Steve! I didn’t want to muddy the argument with the idea that you might need to take cash from a struggling unit, but that’s the situation I’m in here in Anchorage. We have a business that’s been fundamentally declining for years now, yet we still have to grapple with the innovation problem.

It may be that our “Macintosh division” will have to be started outside the company entirely, as Stephen Hill has suggested in other comments on this site and on his own.

I’d like to think we’re smart enough to reinvent ourselves in situ, but that’s definitely a long shot. Most companies are unable to innovate away their history.

My hope is that we’re small enough to be able to turn things around without imploding in the process. By changing out some key positions (employees) and our organizational structure, we might just be able to make it.

Well, it would have been interesting to have seen Apple develop a 32 bit Apple II. The IIgs, a 16 bit machine, sold remarkably well, but was deliberately crippled by Apple. You couldn’t buy one in a store that had a built-in hard drive, even though the GSOS was quite advanced, and had a marvelous color GUI while the Mac was still struggling along with B&W. Of course, the Apple II also had rectangular pixels, as opposed to the Mac’s square ones, which made detailed graphics a bit blocky, but all that could have been programmed into the hardware and OS if they chose.

Imagine how successful the Mac would have been if Apple continued to sell them with floppy drives only…

-=-Ron-=-

Well, it would have been interesting to have seen Apple develop a 32 bit Apple II. The IIgs, a 16 bit machine, sold remarkably well, but was deliberately crippled by Apple. You couldn't buy one in a store that had a built-in hard drive, even though the GSOS was quite advanced, and had a marvelous color GUI while the Mac was still struggling along with B&W. Of course, the Apple II also had rectangular pixels, as opposed to the Mac's square ones, which made detailed graphics a bit blocky, but all that could have been programmed into the hardware and OS if they chose.Imagine how successful the Mac would have been if Apple continued to sell them with floppy drives only…-=-Ron-=-

The major difference I see between public broadcasting (i.e. non-profit) companies and for profit companies like Apple is Profit (excess revenues over expenses). Generally, our revenues are barely covering the expenses needed to provide the services that generate the revenues. We don’t have profits from our “Apple II” business to invest in a new division. In my experience, that has been the big challenge and frustration for public media companies trying to invest in new media while keeping existing revenue generating services going.

(Disclosure: Karen and I presently work in the same company.)

For me, “profit” occurs any time your income outpaces your expenses and/or you’re in a position to decide where to invest that excess cash. Whether you’re incorporated as a nonprofit or not, this should be happening virtually all the time if you’re running the business well.

The common (and I would argue “simplistic”) nonprofit approach is to raise expenses higher and higher to absorb all that income. But we shouldn’t be in the habit of spending every last penny. We need reserves. We need risk capital. We need funding for both rainy days and for investing in new services when they’re needed to fulfill our mission. What we need is a guideing strategy that controls investments in service of a mission/goal larger than an annual budget or quarterly balance sheet.

From what I’ve seen so far, there are lots of public media companies making enough money to be able to fund new ventures, both out of their own coffers and will help from foundations, the CPB, etc. It’s a matter of priority, a matter of choice.

But let’s go one step further.

We’re in a period of rapid and far-reaching media change, yes? We have income from the old media model that we’ve been using for the past 30-40 years. But that income is beginning to decline (in a macro sense; individual station experiences will vary).

In this situation — falling income / rapid media change– do you…

[1] Take the income you’re still getting and invest further and further into the declining model, in the hopes that you’re just not investing enough and this will turn things around?

or

[2] Take the income you’re getting, maintain the old model, but only make capacity-building investments in the new model?

I would suggest that #1 is doomed to failure. The old model is declining for reasons well beyond your own capacity to execute on that model. It’s not an efficiency or effectiveness problem, it’s a strategic innovation problem.

Apple’s take was to maintain the old model for a long time in parallel with the new model. The Apple II series went on for years after the Mac’s 1984 introduction. Indeed, variations of the Apple II were on sale through 1992 — 8 years after the Mac’s introduction (although the last real Apple I innovation arrived in 1989).

For public media companies, I think the Apple model, with some caveats, still makes broad strategic sense. We should maintain existing services in status quo mode, with a few innovations around the edges. Broadcast media is still profitable and in heavy use (esp. in certain demos) and worthy of support. But all our risk capital, our strategic investments, should be made in new technologies, new platforms — the things that will last the next 10, 20, 30 years.

We won’t get rich building these new interactive community media platforms. And perhaps the scale of public broadcasting’s old success can never be achieved again anyway. But if the spirit and mission of public media is to survive in a new world, we’re going to have to redirect our cash and commitment.

If we operate with a mental model that says “we don’t have the money for that,” then we’re done here.

For me the vital aspect is to put the disruptive unit into a separate world. Then give that the protection that it will need when it looks successful